How to Verify Account on Bitunix

How to Complete Identity Verification on Bitunix

Where can I get my account verified?

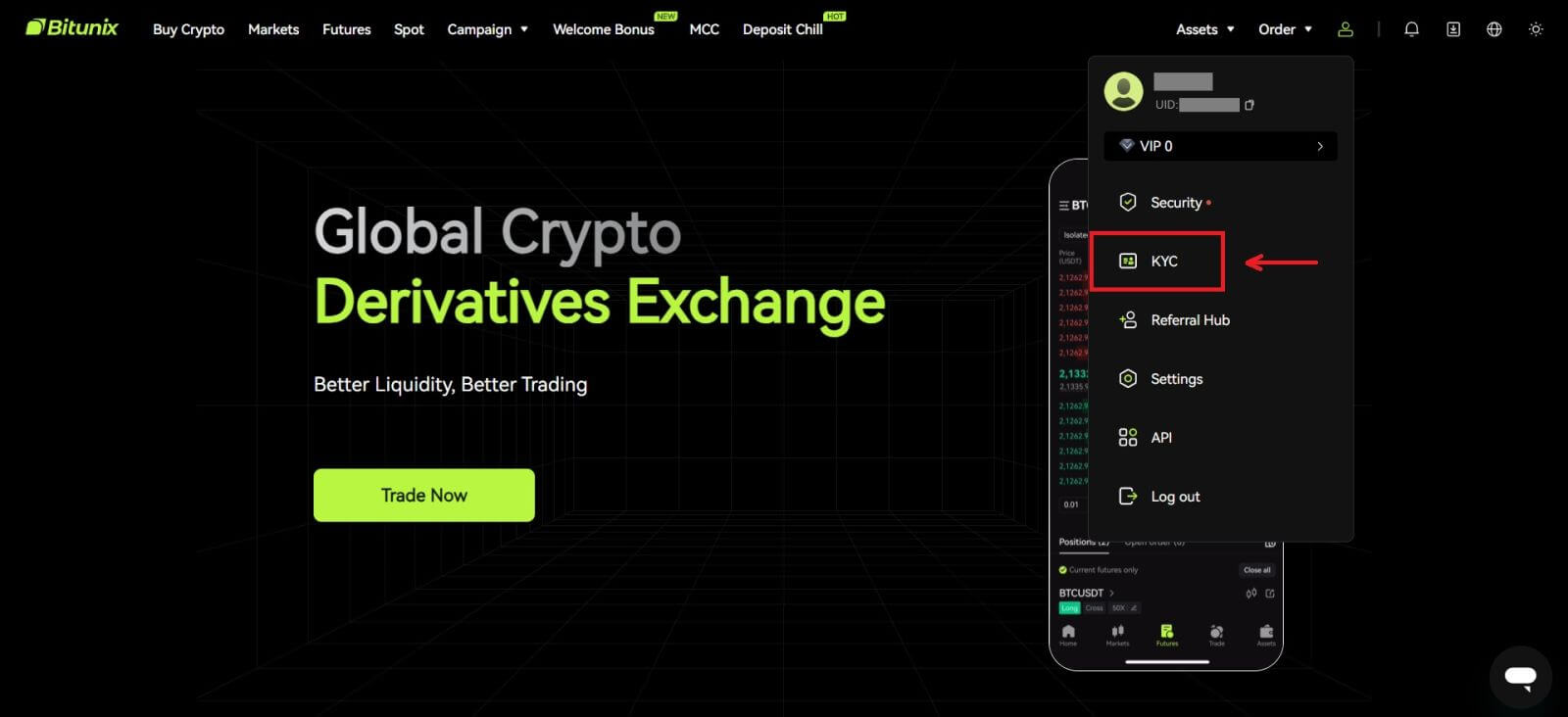

You can access the Identity Verification from your [Avatar] - [KYC]. You can check your current verification level on the page, which determines the trading limit of your Bitunix account. To increase your limit, please complete the respective Identity Verification level.

How to complete Identity Verification? A step-by-step guide

Basic Verification

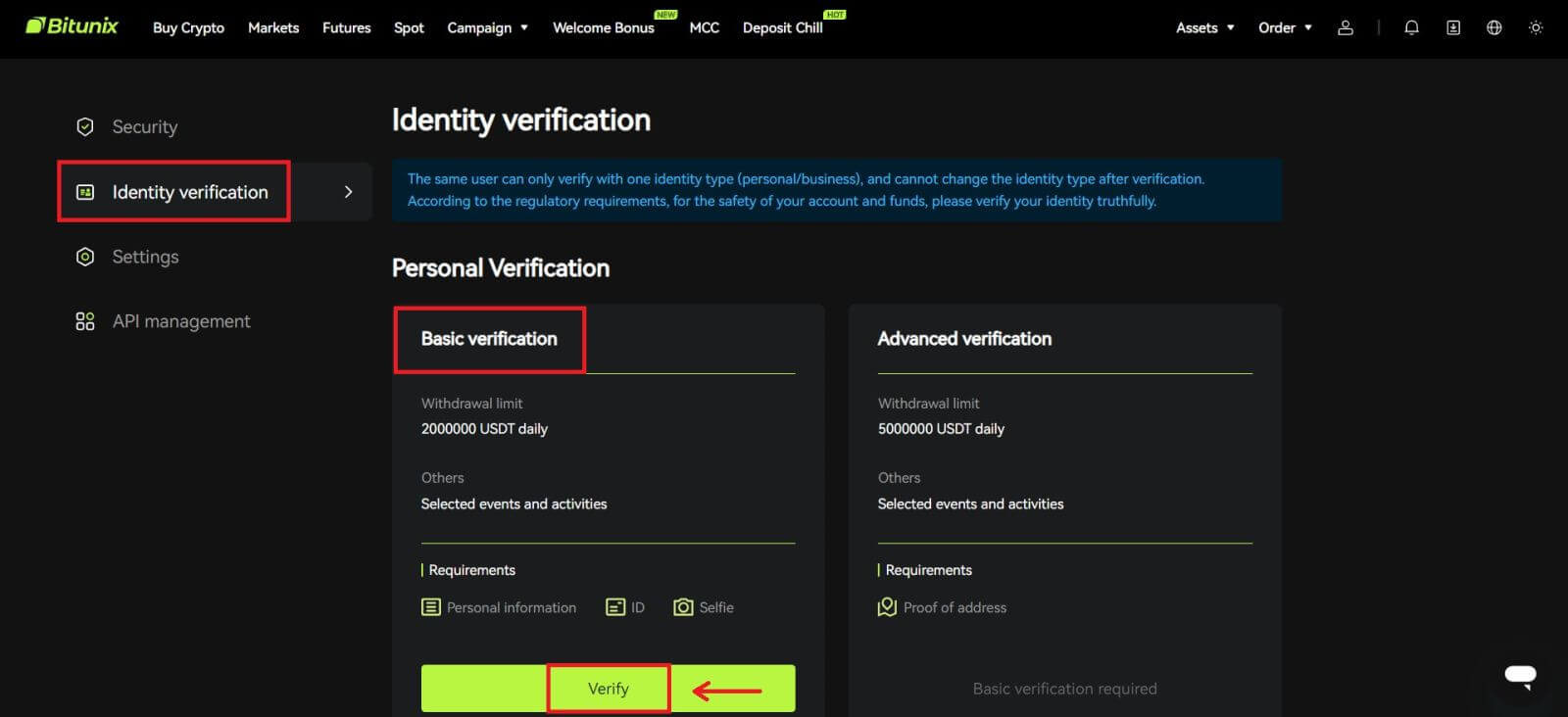

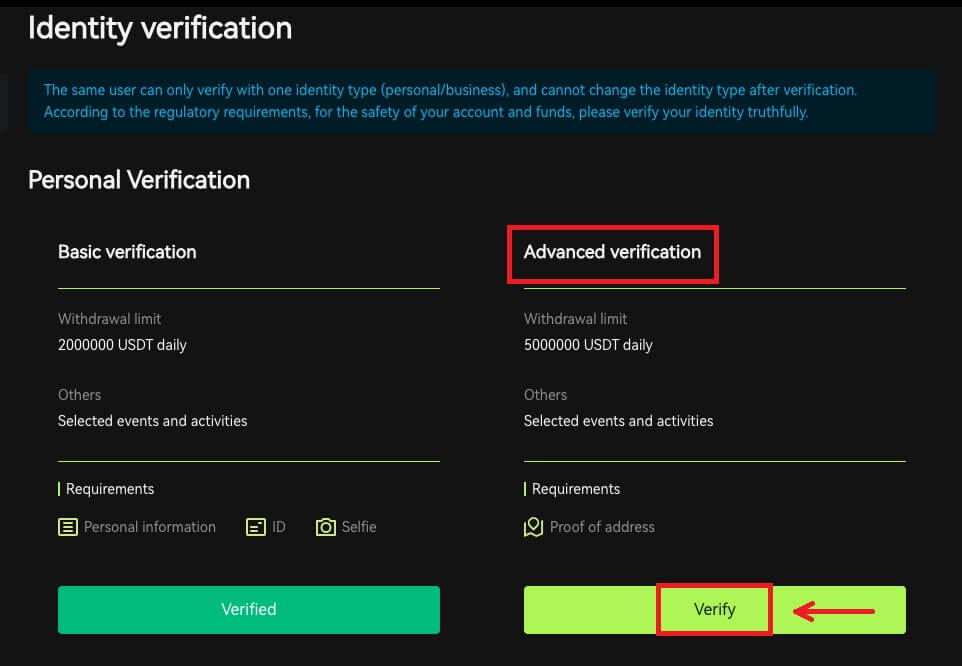

1. After landing on the “Identity verification” page, select “Basic Verification”, or “Advanced Verification” (Completing basic verification is required before advanced verification). Click [Verify].

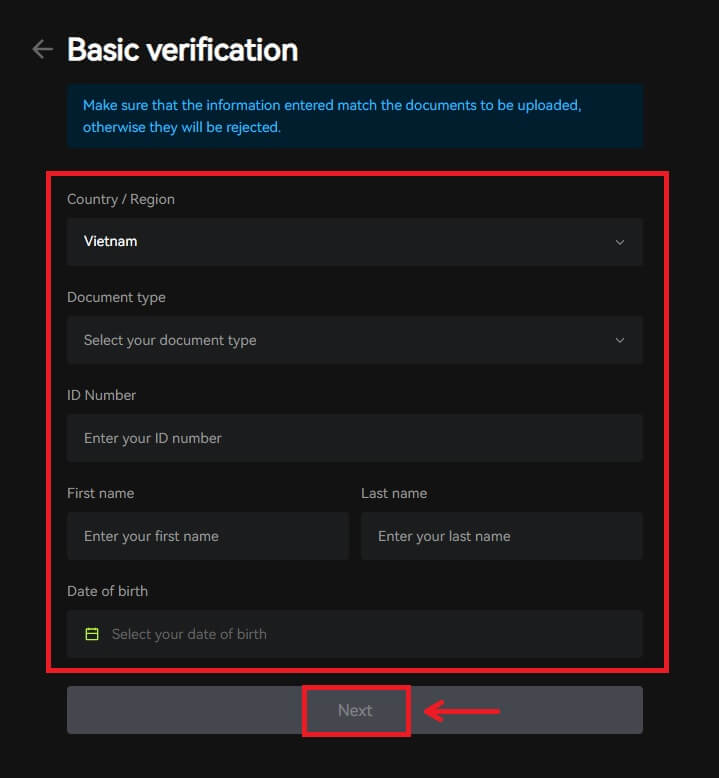

2. Select country or region, ID type, and enter your ID number, name and date of birth following the instructions, click [Next].

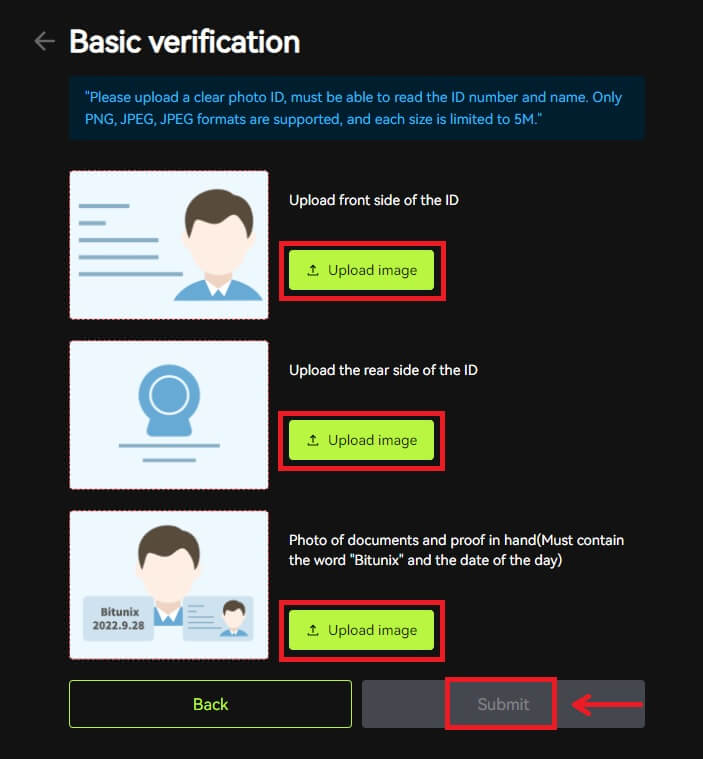

3. Upload the front and the back of your selected ID, as well as a photo of you holding your ID and a paper with Bitunix and the current date written, click [Submit]. KYC verification will be completed after Bitunix reviews the documents and the information you have submitted.

Advanced Verification

1. After completing the basic verification, you can now verify for advanced verification. Click [Verify] to start.

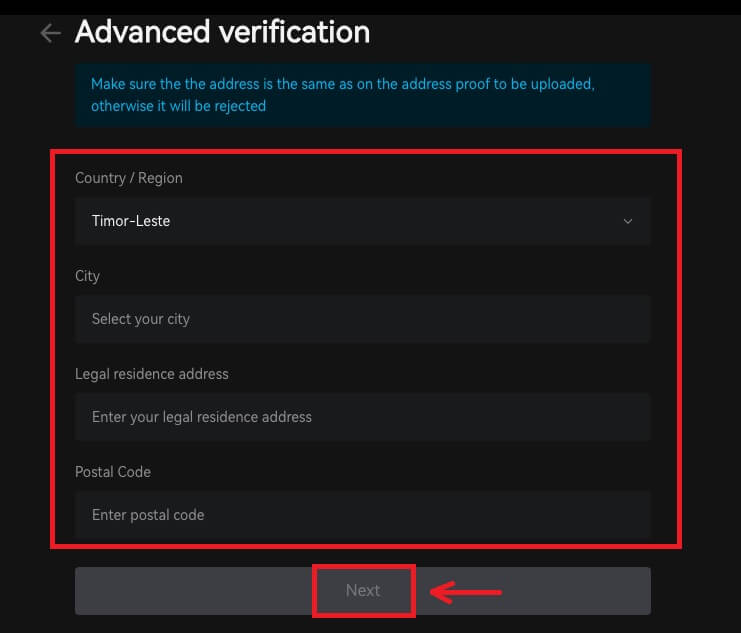

2. Select the country/region, and enter the city, legal residence address and postal code, click [Next].

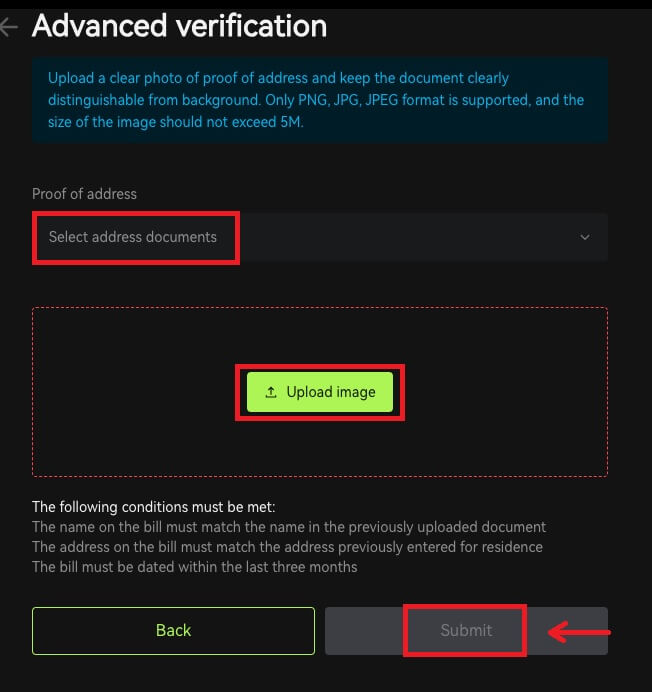

3. Upload a valid proof of address following the instructions, click [Submit]. Advanced KYC verification will be completed after Bitunix reviews the documents and the information you have submitted.

3. Upload a valid proof of address following the instructions, click [Submit]. Advanced KYC verification will be completed after Bitunix reviews the documents and the information you have submitted.

Note

1. Identity Cards must have a photo with both sides. Please provide official English translation for Non-Roman Letters.

2. Please provide a photo of you holding your passport or photo ID. In the same picture, you need to write down the date - and a note with the word ’Bitunix’. Make sure your face is clearly visible and that all information on the ID is clearly readable.

3. Proof of address (a statement such as a utility bill, letter from a government dept., tax statement outside of your banking information no older than 90 days - clearly indicating your name and residential address. The document must be in Roman Lettering, or a certified English translation should be uploaded in addition to the original document.

4. Accepted document types: JPG /PNG/JPEG, and the maximum size of the files is 5M.

Frequently Asked Questions (FAQ)

Why should I get my account identity verified?

Users are required to verify their identity at Bitunix by going through our KYC process. Once your account is verified, users can apply to raise the withdrawal limit for a specific coin if the current limit cannot satisfy their needs.

With a verified account, users can also enjoy a faster and more smooth deposit and withdrawal experience. Getting the account verified is also an important step to enhance the security of your account.

What are the KYC Tiers and Benefits

KYC policy (Know Your Customer Well) is an enhanced scrutiny of account holders and is the institutional basis for anti-money laundering used to prevent corruption, and is a series of procedures by which financial institutions and cryptocurrency exchanges verify the identity of their customers as required. Bitunix uses KYC to identify customers and analyze their risk profile. This certification process helps prevent money laundering and the financing of illegal activities, while KYC certification is also required for users to increase their BTC withdrawal limits.

The following table lists the withdrawal limits at different KYC levels.

| KYC Tier | KYC 0 (No KYC) | KYC Tier 1 | KYC Tier 2 (Advanced KYC) |

| Daily Withdrawal Limit* | ≦500,000 USDT | ≦2,000,000 USDT | ≦5,000,000 USDT |

| Monthly Withdrawal Limit** | - | - | - |

*Daily withdrawal limit updated every 00:00AM UTC

**Monthly Withdrawal Limit = Daily Withdrawal Limit * 30 days

Common Reasons and Solutions for KYC Verification Failures

The following are common reasons and solutions for KYC verification failures:

| Rejected Reason | Possible Scenario | Solutions Tips |

| Invalid ID | 1. The system has detected that your full name/date of birth on the profile is incorrect, missing or unreadable. 2. The uploaded document does not contain your face photo or the photo of your face is not clear. 3. The uploaded Passport does not contain your signature. |

1. Your Full name, Date of Birth, and Validity date need to be shown clearly and readable. 2. Your facial features need to be clearly displayed. 3. If you are uploading a Passport image, please make sure the passport has your signature. Accepted Proof of Identity Documents include: Passport, National Identity Card, Residence Permit, Driving License; Unaccepted Proof of Identity Documents include: Student Visa, Working Visa, Travel Visa |

| Invalid document photo | 1. The quality of uploaded documents may be blurred, cropped or you have masked your identity information. 2. Uploaded irrelevant photos of identity documents or proof of address. |

1. Your Full name, Date of Birth, and Validity date need to be readable and make sure that all the corners of the document are shown clearly. 2. Please reupload any acceptable identity documents such as your Passport, National identity card, or Driving license. |

| Invalid proof of address | 1. The proof of address provided is not within the last three months. 2. The proof of address provided shows another person’s name instead of your name. 3. An unacceptable document for proof of address submitted. |

1. The proof of address must be dated/issued within the last three months (documents older than three months will be rejected). 2. Your name must be clearly shown on the documents. 3. It cannot be the same document as Proof of Identity. Accepted Proof of Address Documents include:Utility bills Official bank statementsResidential proof issued by the governmentInternet/cable TV/house phone line billsTax returns/Council tax bills Unaccepted Proof of Address Documents include: ID card, Driver’s license, Passport, Mobile phone statement, Tenancy agreement, Insurance document, Medical bills, Bank transaction slip, Bank or company referral letter, Handwritten invoice, Receipt for purchases, Border passes |

| Screenshot / Not original document | 1. The system detects a screenshot, scan copy, or printed document that are not acceptable. 2. The system detects a paper copy instead of the original document. 3. The system detects black and white photos of documents. |

1. Please make sure the uploaded document is the original file/PDF format. 2. Please make sure the photo uploaded has not been edited with image processing softwares (Photoshop, etc) and it is not a screenshot. 3. Please upload a colored document/photo. |

| Missing document page | Some pages from uploaded documents are missing. | Please upload a new photo of the document with all four corners visible and a new photo of the document (front and back sides). Please ensure that the document page with important details is included. |

| Damaged document | The quality of the uploaded document is poor or damaged. | Make sure that the entire document is visible or readable; not damaged and there is no glare on the photo. |

| Expired document | The date on the uploaded identity document is expired. | Make sure that the identity document is still within the validity date and not yet expired. |

| Unrecognized language | The document is uploaded in unsupported languages such as Arabic, Sinhala, etc. | Please upload another document with Latin characters or your international passport. |